China's economy to rebound with huge mkt potential

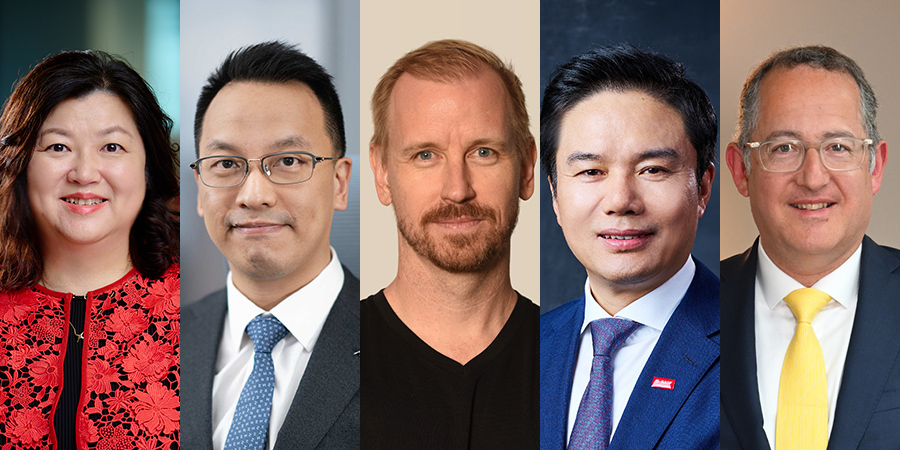

Editor's note: With strong policy support, unremitting technological innovation and industrial upgrading, China's economic recovery continued to gather steam in the third quarter, with its GDP expanding by 4.9 percent from a year earlier, leading to a 5.2-percent year-on-year growth in the first three quarters. China Daily presents a series of Q&As with top multinational corporation executives, discussing their perspectives on the Chinese economy and how they will position future business in China.

Q1 Given the complex current global economic and geopolitical situations, how do you position the Chinese market in your overall global business radar? What's your outlook for China's economy and your company's operations in the country for this year and next?

CHENG: There are global concerns about China's economic growth following its COVID-19 response optimization. However, I believe that the current pace of economic growth is temporary. With the government's latest announcements to stimulate the economy, I believe a lot more stimulus measures will be rolled out. We expect to see in the second part of this year and in 2024 a rebound of the economy. We will further tap Singapore's experience as an international financial center and DBS Group's resources to support China and the businesses here. At DBS China, we will continue to support the country's real economy and its high-quality growth. We will beef up our support to China's inbound and outbound flows and capitalize on existing and emerging opportunities. We will also expand, deepen and sharpen our coverage in focused industries and segments. DBS will continue to actively support Chinese enterprises to go global, especially in response to the Belt and Road Initiative and/or under the Regional Comprehensive Economic Partnership, supporting them in infrastructure construction and project financing in related regions and markets, and helping them set up a regional headquarters or treasury center in Singapore to further expand their business network to Southeast Asia.

CHOR: As the world's second-largest economy, China's huge market and strong consumer demand continue to provide vast market opportunities for businesses across the globe. The continued opening-up of China's financial market is a valuable opportunity for foreign-owned insurers like AXA Tianping to explore more business development opportunities. The establishment of the Shanghai Reinsurance Hub is a prime example and we are glad to be a part of this milestone. On Aug 14, AXA Tianping Shanghai Reinsurance Operation Center received approval from the National Administration of Financial Regulation, making us one of the first insurers to have a presence in the International Reinsurance Trading Center in Lingang New Area (in Shanghai). The AXA Tianping Center officially launched on Aug 20. Looking ahead, AXA Tianping will move the reinsurance functions of the group office to Shanghai. We will also consolidate reinsurance resources and functions across various departments, including finance and business, to take full advantage of a centralized platform to improve operational efficiency and streamline workflows. We strive to help promote the high-quality development of China's insurance and reinsurance industry in areas such as risk management, underwriting capacity and service level, thus contributing to social prosperity and stability.

MENSE: China has been a miracle story in its meteoric rise to become an economic superpower. Many companies, foreign and domestic alike, have become highly successful in finding the right model to fit the demanding Chinese consumers. At AppsFlyer, we have established a unique market position of helping domestic Chinese consumer brands bring their services to the world in the global app economy for over a decade now. I would say that the population benefit of China did not fade away, because the advantage right now is favorable toward China and the position that it is in. It has always been in AppsFlyer's DNA to help our customers understand the markets that they are interested in, how they should navigate those markets, and how they should make the right decisions so that they can be even more successful. Our job was, is, and will always be, to help our partners be successful. AppsFlyer is very much committed to this long-term partnership.

LOU: The Chinese market is of strategic significance to BASF. Today, China accounts for half of global chemical production, making China BASF's second-largest market. Our investments in China are in line with BASF's strategy of producing where our customers are and where there is market growth. As one of the largest foreign investors in the Chinese chemical industry, BASF has invested over 13 billion euros ($13.7 billion) in China with its partners over the past decades. We have a firm belief in the market potential of China. Our large manufacturing footprint, our leading position in sustainability, and growing innovation capabilities in China provide an excellent foundation to grow and develop with our value chain partners.

DEPOUX: The Chinese government announced a modest target of China's GDP at around 5 percent in early 2023, which signaled challenges in the current conditions. The Chinese economy fared well under the huge and combined pressures of trade frictions, the pandemic, fluctuations of global demand and the geopolitically driven "de-risking". Thanks to improved productivity, broad industrial clusters and well-established infrastructure, China was, is, and will remain the factory of the world. The combination of a broad local market and a strong legacy export base makes China difficult to replace. We believe that China's fundamentals remain strong despite a difficult transition in the short term. That global factory is producing more added value now thanks to the massive industrial modernization effort. China is an important market for Roland Berger. Changing market conditions and uncertainty fuel the need for performance, agility, competitiveness and innovation, which we are helping our Chinese and multinational clients to achieve. Moreover, China is an important source of global innovation in multiple fields, from payment, retail and e-commerce to the electric vehicle value chain and energy transition. Operating in China is a source of global competitiveness.

Q2 China's economic policymakers have assured greater efforts to attract foreign capital, widen market access and ensure a level playing field for both domestic and foreign companies. In this context, what new policy measures do you expect from Chinese authorities in the near future?

CHENG: I expect near-term policy measures will revolve around boosting consumption, ensuring cross-border supply chain resilience, stabilizing investments and supporting technological development. We intend to focus on these areas of opportunity. One area would be the further internationalization of the RMB, where we see ourselves being able to play an important role. For instance, DBS is among the first batch of banks selected to participate in China's cross-border international payment system. Improving the financial infrastructure for the internationalization of the RMB is essential, and the launch of CIPS will bring China closer to having a major currency for both trade and investment purposes. We look forward to combining CIPS with financial innovation to provide greater convenience and a wider variety of RMB products for our clients. DBS' participation in CIPS demonstrates our commitment to being at the forefront of transaction banking to provide clients with connectivity to the latest payment services and market infrastructure.

CHOR: As the largest wholly foreign-owned P&C insurer in China, AXA Tianping has benefited from close economic ties between China and France and a favorable investment environment for foreign enterprises in China. The Sino-French relationship provides a solid foundation for the steady development of AXA Tianping, and creates confidence and stability in the local market. Recently, we became one of the first insurers to have a presence in the International Reinsurance Trading Center in Shanghai. To enhance the infrastructure and operation of the reinsurance market, the center is dedicated to developing a new forward-looking reinsurance transaction system through digitalization and utilizing the reinsurance registration, clearing, and settlement platform. To expand supply and deepen innovation of reinsurance products, it is crucial to establish a data exchange and resource integration system that will improve reinsurance underwriting capabilities and service quality. We expect more supportive policies to be introduced for the center to enhance its position as a global reinsurance hub equipped with advanced technology, capital and talent.

MENSE: China is the most tech-savvy country and offers immense opportunities for businesses in the e-commerce, fintech, digital payment and other digital services sectors. It's important to understand and establish your market niche, be ahead of the innovation curve in order to provide your customers with cutting-edge, mission-critical technology to help make them successful.

We realized early on that it is difficult to navigate this complex market that can be challenging due to cultural differences, regulatory changes, and competition. So, we focused on what we know best — to continue to help some of the greatest brands of our time to adapt to the changing global landscape and navigate stringent privacy regulations. In more ways than one, China is shaping the future of the global technological landscape. With China's unrivaled leadership, we look forward to continuing to revolutionize marketing technology on an international playing field. AppsFlyer is a tech company and we hope for more technological and innovation support. China has been actively promoting technological innovation and development in areas such as artificial intelligence, digital economy, clean energy, and high-tech manufacturing. More policies supporting these can be expected in the coming days.

LOU: BASF is very much encouraged by China's shift toward a high-quality, eco-friendly development model. We support the formulation and implementation of comprehensive and transparent regulations, and standards that govern carbon management. Furthermore, we advocate for policies that favor low-carbon technologies and products, thereby expediting the development and commercialization of our advanced product solutions. Policy plays a pivotal role in this energy transition. We hope that the Chinese government will establish a regulatory framework that provides market-driven incentive schemes for companies to accomplish the low-carbon transformation.

DEPOUX: China's FDI figures slumped sharply in the second quarter of 2023. In fact, this is a consequence of a rocky 2022, with COVID-19-related disruptions that were not very conducive to making investment decisions. Clarity, certainty and predictability are highly important to rebuild confidence and restore the interest of foreign businesses in China. Communication, explanation, clarifying the purpose of policies and creating a transparent framework always help achieve more confidence. Most importantly, FDI is a function of attractiveness combined with growth and profitability potential. Structural reform is needed to accelerate the transformation of the Chinese economy and ensure its long-term vitality. Foreign and Chinese companies are in the same boat and expect a stable growth perspective, driven by favorable fundamentals.

Q3 As China continues to pursue high-quality development through a homegrown path to modernization, what is the vision for your company's business in the country over the long run? What business opportunities do you foresee emerging as part of the process of Chinese modernization?

CHENG: To prioritize "quality" economic growth and drive "green" and "sustainable" development, one crucial opportunity is decarbonization. We see net-zero as one of the key themes of the future. This is also in line with China's climate goals. Many of our clients share the same philosophy and are developing and implementing robust plans to decarbonize and transition. We expect that these plans will inevitably involve financing and investments, be it in new lines of low-carbon businesses and technologies, proactive retirement of carbon-intensive assets at the risk of being stranded or made obsolete, or reconfiguring the supply and distribution chains. This paradigm shift will affect all industries in the coming decades and will require massive investment. As estimated by the Intergovernmental Panel on Climate Change in 2021, this would amount to an additional $3.5 trillion investment annually.

CHOR: Currently, China's insurance penetration is far lower than the level of developed countries. The overall business structure of the insurance industry continues to undergo optimization. This means that the Chinese market has broad growth prospects and can be expected to maintain good development potential. At the policy level, the government has increased its support for the insurance industry and introduced a series of measures to encourage innovative development and improve service quality, bringing new development opportunities to relevant insurance types. China's continued reform and opening-up have presented an invaluable opportunity for AXA Group to deepen its presence in the country. AXA Tianping will make full use of China's constantly improving business environment and explore the full potential of the enormous market. We look forward to contributing our share in establishing the new development pattern so that more Chinese consumers have the opportunity to enjoy innovative, high-quality protection solutions.

MENSE: China's path to modernization is most exemplified when stepping into a city like Shenzhen — what was once a grid of factories, laborers and pollution-spewing trucks has become a city of skyscrapers, a melting pot of entrepreneurial Chinese from every corner of the nation, and electric powered vehicles that move quietly across the wide roads. If this is an example of what China can become, then the future is bright and full of opportunity. Strong emphasis is placed on technological advancement and innovation, which is a key driver of modernization. In practically all aspects of modern-day technology, China has been leading the way. This is particularly true in our field of marketing measurement, where China remains the blueprint of economic success and ecosystem collaboration. Businesses that can offer cutting-edge technologies, research and development capabilities, and innovative solutions may find opportunities to partner with Chinese counterparts or supply to the domestic market. China has also proven to be committed to sustainable development and environmental protection, which creates opportunities for businesses specializing in renewable energy, green technologies, waste management, and other environmentally friendly solutions. This focus on the balance between progress and environmental well-being is noteworthy.

LOU: At BASF, we believe that innovation and sustainability are the two key drivers of modernization to achieve high-quality development. This aligns well with China's national development goals. For example, we are strengthening our positioning in battery materials in China to support the electric vehicle industry. Sustainability is another lever for our business development in China. We are continuously optimizing existing processes, replacing fossil fuels with renewable energy sources, and developing radically new low-emission technologies. We also see significant opportunities in providing sustainable and energy-efficient solutions. With our value chain partners and stakeholders in China, we are committed to driving the low-carbon transformation together.

DEPOUX: There are three key drivers leading China's future development: industrial modernization, energy transition and decarbonization, and transformation of domestic consumption. Technology and innovation are key to bringing disruptive changes to the Chinese economy. We have seen China leapfrogging in some new areas, such as EVs, energy storage, photovoltaic and wind power. In the area of decarbonization, technology is not everything, and services, activating specialized know-how are at least as important — providing strong potential for foreign companies to strive in China. In the meantime, for our company, as well as many other foreign companies in China, it is important to focus on transformation and performance improvement that help us to succeed in a more competitive environment.