Preferential tax policies of Anhui province for foreign-invested enterprises

Ⅰ. Income Tax Incentives for Foreign-invested Enterprises and Foreign Enterprises

1.General tax incentives (applicable to those enterprises in Anhui)

(1) Any productive foreign-invested enterprise with operating period of no less than 10 years shall, upon approval by the competent department for tax affairs, be exempted from business income tax for the first two profit-making yeas and allowed a 50-percent reduction in the third to fifth years.

(2) After the time limit of being treated as "two-year exemption and three-year reduction by half", any foreign-invested enterprise engaged in agriculture, forestry and animal husbandry or any foreign-invested enterprise established in the remote underdeveloped areas may, upon approval by the State Administration of Taxation, be allowed a 15-30 percent reduction of income tax payable in the following 10 years.

(3) Income tax shall be levied on Chinese-foreign joint ventures engaged in port and harbor construction at a reduced rate of 15 percent. With operating period of over 15 years, they shall be exempted from income tax for the first five profit-making years and allowed a 50 percent reduction in the sixth to tenth years.

(4) In accordance with the tax provisions of the State, the period for 50 percent reduction in income tax may be extended for 3 years for those foreign-invested enterprises that use advanced technology and still keep technologically advanced after the expiration of period of "two-year exemption and three-year reduction by half". The reduced tax rate is no less than 10 percent.

(5) After expiration of the period allowed for reduction or exemption of income tax in accordance with provisions of the State, the export-oriented enterprises with their current year's export value attaining 70 percent of their total output value, shall pay the business income tax by half. The rate is no less than 10 percent of the current tax rate.

(6) Any foreign investor of foreign-invested enterprise who reinvests his share of profit obtained from the enterprise directly into that enterprise by increasing its capital, or uses the profit as capital investment to establish other foreign-invested enterprise with operating period of no less than five years shall, upon approval by the tax authorities, be refunded 40 percent of the income tax already paid on the reinvested amount. Foreign investors who reinvest the profits distributed by the enterprise to establish or expand export-oriented enterprise or technologically advanced enterprise for a period of no less than five years shall receive a full refund of enterprise income tax already paid on the amount of reinvestment.

(7) Losses incurred in a tax year within the foreign-invested enterprises and production sites or business operations set up in China by foreign enterprises may be made up by the income of the following tax year. Should the income of the following tax year be insufficient to make up for the said losses, the balance may be made up by its income of the further subsequent year, and so on, over a period not exceeding five years.

(8) All foreign-invested enterprises will be exempted from the local income tax.

2. Tax incentives for foreign-invested enterprises in the urban districts of Hefei and Wuhu Cities

(1) The income tax on productive foreign-invested enterprises established in the old urban districts of Hefei and Wuhu shall be levied at the reduced rate of 24 percent.

(2) For any foreign-invested enterprise engaged in technology-intensive or know-how intensive projects, or in energy, transportation and harbor construction projects, or in projects with total investment exceeding USD 30 million, upon approval by the State Administration of Taxation, its business income tax shall be levied at the reduced rate of 15 percent.

(3) For the export-oriented enterprise with foreign investment, the business income tax shall be levied at the reduced rate of 12 percent.

3. Tax incentives in the Wuhu Economic and Technological Development Zone and the Hefei State New & hi-tech Industrial Development Zone

(1) The business income tax on the productive foreign-invested enterprise in the Wuhu Economic and Technological Development Zone shall be levied at the reduced rate of 15 percent.

(2) For the foreign-invested enterprise classified as hi-tech one in the Hefei State New & hi-tech Industrial Development Zone, its business income tax shall be levied at the reduced rate of 10 percent.

Ⅱ. Other Tax Incentives

1. The foreign-invested enterprises are exempted from the investment orientation regulation tax on fixed assets.

2. The foreign-invested agricultural projects with a view to earn more foreign exchanges and to reform rural and township enterprises may, with the approval of the provincial government, enjoy the preferential policies for export-oriented enterprises, under the condition that their actual export value of agricultural products is 50 percent higher than the current year's total output value.

3. Foreign-invested enterprise which products are sold directly to overseas markets are exempted from value added tax and consumption tax unless there are special regulations by the State.

4. For the State-encouraged foreign-invested projects, the land-using fees are charged at a low limit.

MOST POPULAR

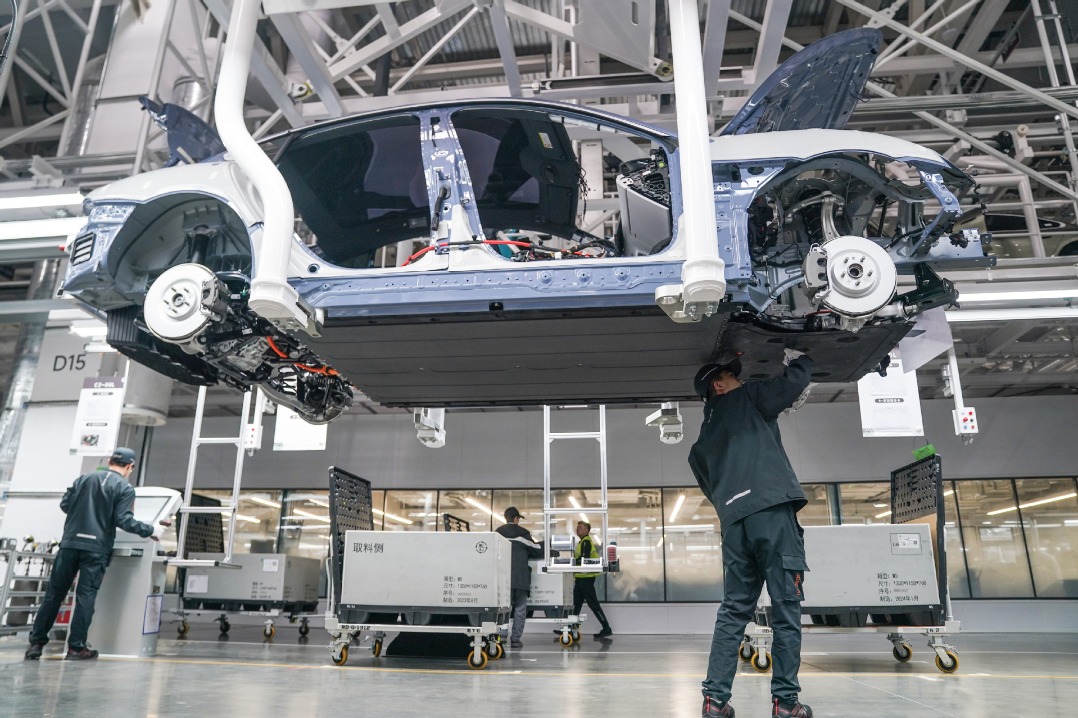

- 1 A look at China's economy in Q1 of 2024

- 2 China to remove foreign ownership restrictions in value-added telecom services in pilot areas

- 3 Query service of A Guide to Working and Living in China as Business Expatriates launched

- 4 Clear negative lists to speed up services trade

- 5 Canton Fair opens in China with surge in overseas purchasers

Editors' Picks

Infographic:

How to understand China's production capacity

Infographic:

How to understand China's production capacity

Infographic:

Milestones of China's journey to space

Infographic:

Milestones of China's journey to space